My Rollercoaster Journey of Finances

How do you capture the essence of a turbulent roller-coaster ride in just a few words? 39 years of, battling depression, I still grapple with the unpredictable tides of life. This is the personal untold story of My Rollercoaster Journey of Finances. My story is already out there and my life has been a fast rollercoaster than usual. Not that I am playing the victim here nor do I ever wonder why me.

The Rollercoaster Begins:

My journey through the realm of finances has been anything but smooth sailing. I’ve experienced a few highs and heart-wrenching lows, often within short spans of time. The stormy seas of financial instability have been my constant companion, challenging my resilience and testing my resolve. But I refuse to portray myself as a victim, for that is not the purpose of this narrative. Instead, this is a tale of endurance, growth, and pursuing a brighter tomorrow.

The Terrifying Dive

Yet, amidst the non-existent highs, there have been heart-stopping plunges that left me breathless. Unexpected expenses, economic downturns, and a spinal surgery have sent me hurtling into the depths of uncertainty. During these challenging times, I was learning the art of adaptation, learning to navigate the twists and turns with resilience and grace. It is in these moments of darkness that I’ve discovered my true strength and unwavering spirit.

Lessons Learnt Along the Way:

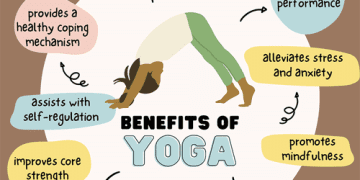

Every twist and turn on this roller coaster ride has taught me valuable lessons. I’ve learned the importance of budgeting, saving for rainy days, and seeking financial education. But I’ve realized the significance of emotional well-being in maintaining a healthy relationship with money. Understanding the connection between our mental state and financial decisions has been a transformative revelation on my journey.

My Rollercoaster Journey of Finances

Five reasons I believe that women who are financially literate are emotionally stable–

1. Be Prepared For The Worst

If you lose your spouse or separate, the expense of living is ominous. It is extremely essential for women to support their families. This starts first with education and getting married after you can financially sustain yourself. To fulfil their family’s needs, they need to work instead of depending on others to put food on the table. Lesson learnt and my daughter is proof of a financially independent woman, living life on her terms.

2. A Stable Life

Monetary independence can improve your standard of living and give you stability. Mine fell many notches low, and I was suddenly an outsider in my society. Not finishing my degree was bothering me a lot, and I somehow graduated after my son was 1 ½ years old. My goals and my wishes flew out of the window. Once I started earning a meagre income, it boosted my self-confidence. I can hold my head high with my self-respect intact. This strengthened me to face life’s challenges.

3. Be Ready For Emergencies

When I was a wee bit contented about my finances, I went in for an emergency spinal fusion. I had no insurance, and no income coming in from anywhere. The meagre savings were now gone. I am extremely proud to say that I have never asked for monetary help.

4. Spend Frugally

We are living in a fast-paced world with expensive gadgets, designer brands, and lavish vacations. It is a rat race and each one of us is trying to overdo the other. In such a scenario, I have seen people splurging on expensive cars and homes, even if they could ill afford it. Banks and private investors are offering loans to everyone and don’t forget the credit cards. Living beyond your means is now a norm and declaring bankruptcy is a part of life.

5. Be role models

Working moms become the role models of their children and it becomes a learning curve for them. They learn how to manage their household, and work life and learn how to channel their priorities. Having been working gave me a lot of confidence and I carried myself well.

Once I stopped working after my spine surgery, it was very difficult to come to terms that I would not be working anymore. Difficult lessons, but they are necessary in our pursuit of financial stability and well-being. I have not reached there yet, but I am confident that in the coming year, I will achieve the financial goals I have set for myself.

This post is a part of Truly Yours Holistic Emotions Blog Hop by Rakhi Jayashankar and Roma Gupta Sinha

This blog post is part of the blog challenge ‘Blogaberry Dazzle’ hosted by Cindy D’Silva and Noor Anand Chawla in collaboration with Dr. Preeti Chauhan.

1

Financial independence is something that i aspired for from my childhood days, because I was raised in such an environment where there was no ge der discrimination and everyone was aspiring to become something in the future. But I never thought I would have to fight this long to become financially independent. But people like you are my motivation so I keep going and never give up. Your life experience is always a great lesson for us, Harjeet.

Dear Harjeet mam,

A big hug from me and I am proud of you and your way of observing life with so much. I am always vocal about woman being independent financially. Honestly I am always in favour of working woman. I myself is the daughter of a both working parent and I am proud to be one. My mom being working gave me the perspective what respect and social status a working woman can have in the society and also in the family affairs. Working women are true role models for me over homemakers and I can say this bluntly. At least my parents dont gave me the chance to get educated to be at home raising kids only and doing household. I will share an incident with you. I had a flourishing banking career which I was pursuing even after marraige and my husband was supportive. But when I saw few of my collegues leaving job as home making their in laws said is the right option for them , I thought why not I too enjoy it. I was soooooooo stupid… I discussed with my husband and he was also in a shock with my decision but never forced me to pursue my career. After resigning I felt like oh what heavenly moments of life am enjoying no pressure to run to office. But trust me within a week I was feeling suffocated, depressed and hopeless…. It was an absolute wrong decision. I gear up and returned back to work but this time in the creative world with full force along with pursuing my diploma in astrology. I am back in life and with my own identity. I am proudly my husband’s wife, my parents daughter, a daughter in law and a mother…. but first I am Samata. I dont want a life of dependent financially…. even if you are stay at home mom, please do something from home as countless jobs and businesses are possible from the comfort of the home. Earn your own money , live your life on own terms and offcourse not overlooking the family and the rule applies for a man also.

Be the role model for your kids. Just loved the topic as it spoke what I exactly feel about women financial independence and its importance.

Regards

Samata

I completely agree that financial stability gives you more credibility and makes you more balanced in your approach. All of us born before the 1990s did not give importance to a career or financial literacy as the societal norm was that the man would provide for us. We have floundered majorly in life, I know that I am going through some major setbacks and trying to remain sane. But, eventually life is a flow, we have to accept the path that it gives and we keep learning along the way. Things might not match out needs or expectations, but we aren’t rock bottom. At least, we have the ability to understand and move on.

Harjeet I feel , it is even more tough to talk about financial wellness as compared to our emotional wellness because our finances seem to be the parameter of status in our society and it hurts our pride to say that we are lacking somewhere.Your mention of being a role model and not giving in to social pressure to flaunt wealth is very much significant in today’s times , where I see people vying for stats symbols before actually acquiring teh status. You have emerged stronger after life’s rough dealings and I have only respect and love for you.

Harjeet, You are braver than you think and much stronger than you can ever imagine. I’m so poor with finances that your post had made me a little nervous, honestly. My husband always tells me that I should at least have the knowledge of our investments and finances, but I have never bothered. Now on, I think, I should pay attention to this weakness and turn it around.

I agree 100% on being financially secure before tying the knot and the necessity of financial literacy. My father insisted on teaching me the latter even if it meant losing out on a few Sundays. Looking back, I am so glad he did since I can manage our finances and investments with ease now. Ditto on the splurging and the vicious credit card debt. The whole “buy now, pay later” and keeping up with the Joneses.

You are a strong woman. One of the strongest I have come across in my life. I have known you up close and I know how you have fought your way up alone. You keep fighting your battle because the war is not yet over .

A big hug to you 💞. I agree with you that having a stable financial situation makes you more trustworthy and helps you approach things more steadily. Your point about setting an example and not feeling pressured to show off wealth is really important, especially nowadays when many people focus on showing off rather than actual achievements. You’ve shown incredible strength after facing tough times, and I deeply respect and care for you. Your life story is always an inspiration for all of us.

I somewhat agree because I began working at the age of 19 and only stopped at 29. I had 10 years of experience and financial independace though I never lived by myself. People wonder why I don’t work anymore. Considering I look, act and talk like the TYPE. Hahahaha! But I have just chosen not to work for now. I feel my kids NEED me. So I just do freelancing and blogging and instagramming for now.

You have faced so many life challenges and yet you pick up the pieces and re-start. You are strong. My father in law lost his battle to cancer at the age of 48. I have seen my mother in law start working for the first time at the age of 48 so that she can support both her kids education and marriage. Today my husband is successful only because she took up the responsibility to provide him with best of education in a private college even though the fees were very high. Today she is 73 and lives alone in Ahmedabad independently. She has multiple health issues. Her kidneys are not functioning properly, she has spinal cord issue, she is unable to walk properly. She is a diabetic, has high blood pressure. All these health challenges never stops her from smiling, laughing, cooking for us whenever we visit. She is my biggest cheerleader. When I decided to restart my career at the age of 40 she supported me completely. I have learnt a lot from her about living life to the fullest. I learnt from her the importance of financial independence even when my mother has been a working lady all her life. I think if you could join support groups, be with like minded people will help you in your life journey. She has her retired bank staff support group, they meet every month and spend time together playing games and having snacks. All this energies her. Even though walking is so difficult for her, she makes it a point to go for these meetings. I read about your life journey in your other post, and you have withstood so much I am sure you will rise out stronger than ever before.

Your Rollercoaster Journey of Finances is a testament to your unwavering spirit and resilience. Your story of facing financial challenges head-on, from unexpected expenses to spinal surgery, is truly inspiring. Your dedication to financial independence and the importance of being prepared for the worst are valuable lessons that will undoubtedly resonate with many. Your journey serves as a guiding light for others, showing that it’s possible to overcome adversity with grace and strength. Your determination to achieve your financial goals is commendable, and your story is a source of inspiration for those seeking stability and well-being. Keep moving forward with confidence, for your experiences and wisdom make you a remarkable role model for others to follow.

Hugs.

You have always been a role model for us, dear Harjeet. Through your blog, you are motivating many people like me. I think these small lessons in life make life big and you are illustrating it. Financial independence is necessary for women, your reasons are quite valid.

Earning money is not financial independence. I know many women who earn but can not save, invest or spend as per there needs or wishes. They always need to take permission to do so.

Understanding rights and taking control of your life and your money at right time is very important.

You’ve faced the ups and downs with grace and learned important lessons along the way. Your emphasis on financial literacy for women is commendable, and your story is an inspiration for many. Keep pushing forward towards your financial goals – you’ve got this!

Harjeet, you are a role model. Despite your circumstances you keep looking up. Your spot light on financial wellness is very timely. It isn’t about weather you are earning or stay home, it’s about having Finanical knowledge as well as independence – which at times is linked to emotional wellness as well. It’s a journey and I hope women feel empowered to take it on. Thank you for bringing awareness to it through your journey.

Your poignant narrative eloquently delves into the tumultuous journey of financial highs and lows. Your experience encapsulates resilience, self-reliance, and the profound impact of financial literacy, especially for women. The lessons and insights you’ve shared serve as a beacon for those navigating similar challenges.

I believe education is the biggest step in becoming empowered, and Harjeet I’m so glad that you have taken this step. I too agree with you about living within one’s means and saving for a rainy day. I just hope that other women learn from your example too.

Financial independence in women is as important as any other life skill and I believe that women do realise that seriously now. My mother was a housewife but I haven’t seen anyone more financially sorted and wise as she was. Dipping into our savings in an hour of need is anytime better than asking for help or taking loans. And also, one can splurge once in a while guilt-free.

You’ve always been an inspiration through your blogs. This post is yet another proof to it. Learning from financial management is a crucial life lesson and I did learn a lot from this through your experience.

Being financially independent takes away a huge amount of stress. You have proved to the world that every battle can be won with true positive spirit.

I liked reading this blog. It is completely news to me because 1, I don’t really have an income and 2, my husband takes care of all my finance related issues. Your blog is an eye opener to me in many ways and while I may not implement them right away, it does make me consider.

After reading your post I realised it takes a lot of courage and trial to tell your story to the world. It’s tough out there and even after 39 years you are sharing with us your story. Thank you for giving us this opportunity. It means a lot.

your emphasis on financial independence is such a crucial part of a woman’s life. It definitely effects the way we take financial decisions in the longer run.

You inspire many women with your life. and these money tips are priceless. We constantly take things for granted, but this blog post has really awakened my eyes, and I’ll be sure that I follow your advice.

I cannot agree more with you financial independence and strength are extremely important in women to be able to lead stable and hassle free life.

Your roller coaster with finances is a learning for all the women out there to prioritise where to spend and where in our present situation the money spent is not benefiting us . An important post about finances.

good points. I agree with you that being financially free is so important, in my opinion, financial literacy should be an important part of our school curriculum as should conversations around it be normalized. Especially women should be encourage to learn about, and manage finances. Sadly, it is only when one faces a hardship that one is forced to learn and level up!

Very well explained all the perspective of financial independence, many of us are earning but don’t have enough knowledge to plan the investment of funds. I have saved this post for my reference further. All your efforts are much appreciated.

I had already told you, your are strong, brave and an amazing person. I dont need to meet you to know that. I loved how you have turned around this beautiful theme.

Hi Harjeet, I could feel myself and my journey in your very honest post. Whatever you have shared, we all have gone through. And what you mentioned that this is a tale of endurance, growth, and pursuing a brighter tomorrow, this is just a beautiful and positive way to look at it. Life is indeed a roller coaster ride and for some of us our finances are our biggest worry and challenge. We are constantly working to earn yet the journey of ups and downs never stops. Knowing how and when to spend wisely is important and your posts highlights the same. Thank you.

Jeet, you are really inspiring us. Your financial journey and your health complications are inspiring. Yes! I can feel it. All your point are truth. Because once you are financially independent and after babies become dependent is not stressed. I am always under a pressure for not earning for myself. With hope I am living that I will be again become financially independent. 🤞

Managing finances and running the family is a sort

of a balance that we need so we can overcome unexpected emergencies and also maintain our peace of mind without the worries and tensions that low finances could give us.

Financial literacy is very important. It should also be taught in school. As an army wife, I managed the finances for every other posting when my husband was in the field. 50 years ago it was not so common but in these times, every woman needs to be more aware.

Having your finances in good health is a must especially if you have a family to support with. It helps to be financially literate for you to know how to put your hard-earned money to good use. Nowadays, knowing how to earn isn’t enough, understanding your expenses is a must as well.

Although I am not financially independent, I know it is important to be. I quit my job to stay at home cuz I was really frustrated with my work life and it has continued for 12 years now. However, among the few things that I expect from my daughters when they grow up, one is to be financially independent.

On a separate note, Harjeet, I wish you good luck for your resolve. I wish you more strength n courage to face life’s challenges and I wish you a Happy New Year!

Your commitment to self-reliance and the pursuit of financial goals is admirable. Your story serves as a guide for others, highlighting the importance of emotional well-being in financial decisions.

Your experience is a lesson for someone else. We all have some battle within us and truely my heart is with you. You are battling hard and I pray that you will be fine and will overcome your hurdles.

I agree with you here. I know that having a stable financial situation makes you more trustworthy and helps you approach things more steadily. It’s crucial that we set an example and resist the need to flaunt our wealth, especially in this day and age where flaunting is more valued than real accomplishments. .

Thanks,Pamela. Living on a castle of glass or paper is surely going to crash